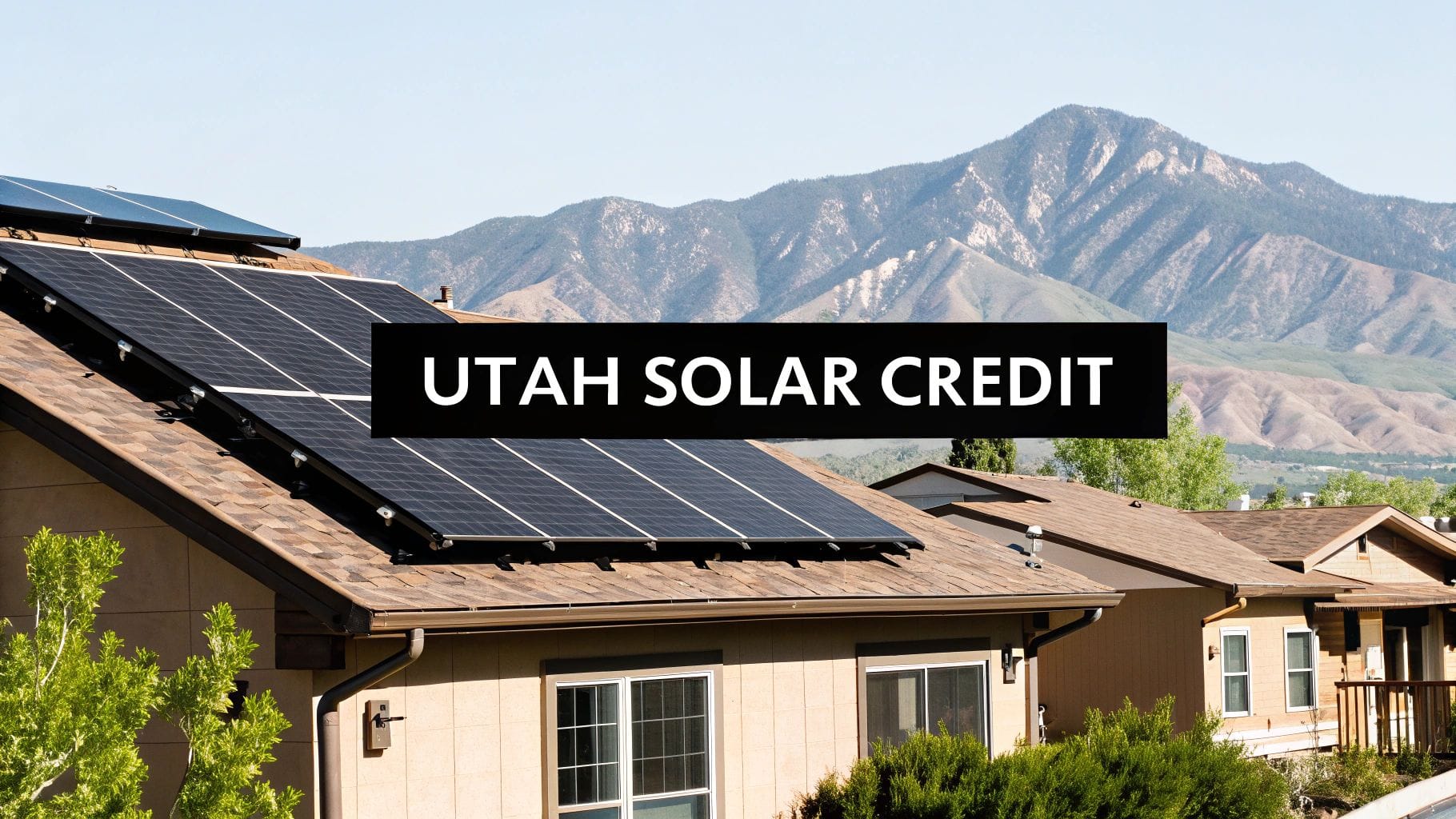

Thinking about going solar in Utah? It's a brilliant move for locking in long-term savings, but navigating the financial side can feel complex. This guide is all about the utah solar tax credit, specifically the powerful 30% federal incentive that makes the switch more affordable than ever. Let me explain how you can leverage it to dramatically slash the cost of your solar panel system.

Contents

- 1 Understanding Your Biggest Solar Incentive

- 2 How the Federal Solar Credit Works for Utah Homeowners

- 3 The Story of Utah's State Solar Tax Credit

- 4 A Step-By-Step Guide To Claiming Your Federal Credit

- 5 Putting It All Together: A Real-World Savings Example

- 6 Why the Best Time to Act Is Now

- 7 Partnering with an Expert for Your Solar Journey

- 8 Frequently Asked Questions About Utah Solar Credits

Understanding Your Biggest Solar Incentive

We're going to demystify the whole process—what the credit is, how it works, and exactly how homeowners across Weber, Davis, and Salt Lake counties are using it to save thousands. Honestly, this incentive is what makes going solar a brilliant investment instead of just a big expense. With a little guidance from our experienced team, you can navigate the system with confidence and make it work for you.

How the Federal Solar Credit Works for Utah Homeowners

Let’s start with the big one: the federal Residential Clean Energy Credit. This isn't just some small rebate or a coupon. Think of it as a powerful, dollar-for-dollar reduction of your federal tax bill, and honestly, it's the main reason going solar in Utah makes so much financial sense right now.

This credit directly slashes the total cost of your solar project, making the whole investment far more manageable. Here's the thing: it’s less like a discount and more like a direct payment that settles a chunk of what you owe the IRS. Getting your head around this is the first step to seeing just how fast a solar system can start paying for itself.

What Costs Are Covered by the Credit?

So, what exactly can you claim? The good news is the credit is remarkably inclusive. It’s not just for the solar panels themselves, but for the entire scope of the project.

Here’s a quick rundown of qualified expenses:

- Solar PV panels used to generate electricity for your home.

- Balance-of-system equipment, which is just the fancy term for inverters, wiring, and the mounting hardware holding everything to your roof.

- Labor costs for all the on-site prep, assembly, and the complete installation—this includes any permitting and inspection fees, too.

- Energy storage devices (that’s your home battery) with a capacity of 3 kilowatt-hours (kWh) or more, whether you install it with your panels or add it later.

Basically, the entire project from start to finish—from planning with an expert like Black Rhino Electric to the final inspection—contributes to your total credit amount. As an experienced electrical contractor, we ensure every eligible cost is documented so you can maximize your return.

Unpacking the Numbers and Timeline

Right now, the Residential Clean Energy Credit lets you claim a whopping 30% of your solar system's total cost.

Let’s make that real. For a typical Utah home, a 5.8 kW system might cost around $17,516 before any incentives. The 30% credit gives you a $5,255 direct reduction on your federal taxes the year after you install. Just like that, your net cost drops to only $12,261.

The Inflation Reduction Act, passed in August 2022, locked this 30% rate in through 2032. After that, it’s scheduled to taper down to 26% in 2033 and 22% in 2034 before it goes away. You can read more about these incentive details and see how they’re helping local homeowners save.

A quick heads-up: The federal solar tax credit is nonrefundable. This just means it can wipe out your tax liability down to zero, but you won't get the extra back as a cash refund. However, if the credit you earned is more than what you owe in a single year, you can carry the leftover amount forward to reduce your taxes in future years.

Who Is Eligible to Claim This Credit?

Eligibility is pretty straightforward for most homeowners in Utah, but a few key rules apply.

You have to own your home—sorry, renters aren't eligible for this one. The solar system also needs to be new and officially "placed in service" (meaning it’s installed and running) during the tax year you claim the credit.

The property also has to be your primary or secondary residence here in the United States. It's important to remember that this credit isn't available for systems you install on rental properties you don't live in. As long as you check these boxes, you’re in a great position to move forward and lock in these major savings.

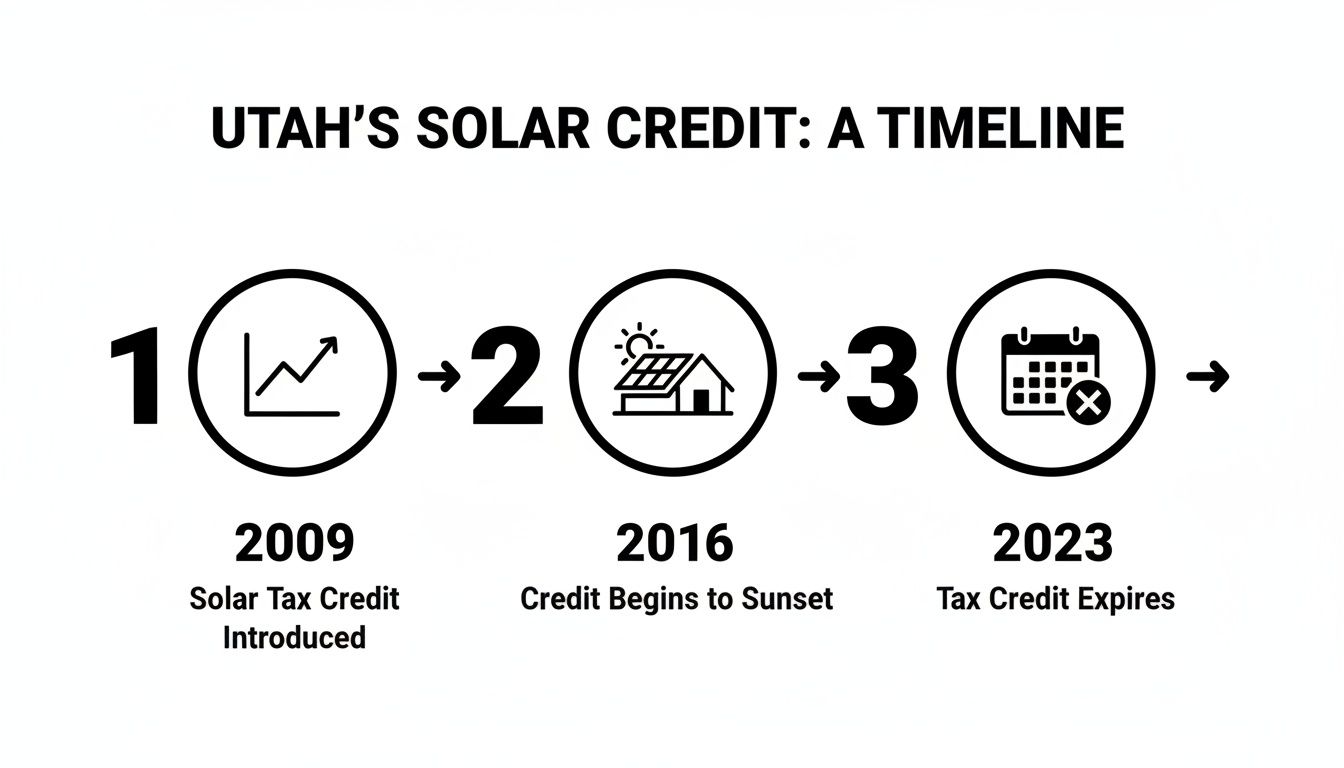

The Story of Utah's State Solar Tax Credit

If you’ve lived in Utah for a while, you've probably heard about the old state-level incentive for going solar. Wasn't that a fantastic program? It helped countless families make the switch and really kickstarted the solar movement across the Beehive State.

Understanding its history helps clarify why the federal credit is now the main game in town for homeowners today.

For years, Utah had its own powerful incentive called the Renewable Energy Systems Tax Credit, or RESTC. It was designed specifically to encourage residents to adopt clean energy like solar. This wasn't a rebate; it was a true tax credit that directly reduced the amount of state income tax a homeowner owed, making that initial investment in solar feel a lot more manageable.

You know what? The program was a huge success. It created a surge in solar adoption that transformed Utah’s energy landscape and positioned our state as a leader in residential solar power.

A Powerful Local Incentive

The RESTC was a percentage-based credit calculated on the total cost of a solar energy system. This meant the more you invested in your system, the larger your state tax credit would be, up to a certain cap. It was a simple, effective tool for lowering the barrier to entry for thousands of Utahns.

This wasn't just a minor discount; it was a significant financial lever that made the numbers work for many households. The credit was so popular that it became a major driving force behind the growth of the solar industry in Weber, Davis, and Salt Lake counties.

The success was undeniable. Utah's RESTC supercharged residential solar adoption, causing applications to skyrocket from a modest 153 in 2009 to an explosive 7,400 in 2016, with 98% of those for rooftop systems.

The Phasedown and Expiration

Like many successful incentive programs, the RESTC was designed with a planned sunset. As solar technology became more affordable and the industry matured, the state began to gradually phase down the credit amount.

Let me explain: this phasedown was a multi-year process. The state credit originally covered 25% of system costs, but the maximum amount you could claim was reduced incrementally over its final years.

It started at a cap of $2,000 in 2017, then stepped down to:

- $1,600 for 2018-2020

- $1,200 in 2021

- $800 in 2022

- $400 in 2023

After December 31, 2023, the credit fully expired for new solar panel systems. You can explore the history of this influential tax credit to learn more about its impact on Utah's energy landscape.

So, to be perfectly clear for anyone shopping for solar today: the Utah state solar tax credit is no longer available for new installations. While its legacy is important, homeowners now rely on the powerful 30% federal tax credit as the primary incentive to reduce the cost of their solar investment.

A Step-By-Step Guide To Claiming Your Federal Credit

Knowing a hefty 30% federal tax credit is out there is one thing. Actually getting that money back into your pocket is another. The process can feel a bit intimidating from the outside, but it’s more straightforward than you might think. Let me walk you through it.

We’ll cover the exact steps, from what paperwork to stash after your installation to filling out the right tax form. Think of this as your roadmap to claiming every single dollar you're entitled to.

Step 1: Keep Your Paperwork Organized

The moment your solar project kicks off, good record-keeping becomes your best friend. The IRS needs to see documentation to verify your expenses, so you’ll want to create a dedicated folder—digital or physical—for everything related to your solar installation.

Think of it like building a case for your savings. Every receipt and contract is a piece of evidence that proves your eligibility.

What should you keep?

- The final signed contract from your installer (like Black Rhino Electric) that clearly details the total system cost.

- Proof of payment, which could be copies of canceled checks, bank statements, or credit card statements showing the full amount paid.

- Receipts and invoices that itemize the costs of all components, from the panels and inverters right down to the labor.

- Any signed permission-to-operate (PTO) documents from your utility company. This officially marks your system's start date and is a critical piece of the timeline.

Having these documents ready will make tax time a whole lot smoother and gives you a clear paper trail if you ever need it.

This timeline shows the journey of Utah's own state-level solar incentive, highlighting key moments in its history before it ultimately expired.

You can see how the state credit fueled solar adoption before it sunset, which really reinforces why the federal credit is now the most important incentive for Utah homeowners.

Step 2: Fill Out IRS Form 5695

When it’s time to file your federal taxes for the year your system was "placed in service," you'll need one specific form: IRS Form 5695, Residential Energy Credits. This is where the magic happens.

This two-page form is used for all sorts of residential energy credits, but you’ll want to focus on Part I, which is for the Residential Clean Energy Credit. Most modern tax software (like TurboTax or H&R Block) will walk you through this with simple questions, but it’s helpful to know what’s coming.

You'll enter the total qualified costs of your solar system—including the panels, equipment, batteries, and all the installation labor. The form then walks you through multiplying that total by 30% (0.30) to calculate your final credit amount.

To give you a clearer picture of the overall process, here's a simplified timeline from start to finish.

Solar Installation and Tax Credit Timeline

| Phase | Key Action | Documentation Needed |

|---|---|---|

| Project Start | Sign your solar installation contract and make initial payments. | Signed contract, proof of initial payment. |

| Installation | System is installed and passes all required inspections. | Final invoices, receipts for all equipment and labor. |

| Activation | Receive Permission to Operate (PTO) from your utility. | Official PTO letter or email. |

| Tax Time | File federal taxes for the year the system was placed in service. | Form 5695, all collected receipts and contracts. |

| Credit Applied | Your tax credit reduces your tax liability for that year. | Your final filed tax return (e.g., Form 1040). |

This table maps out the key milestones, showing how the documents you collect early on become essential when you finally sit down to file.

Step 3: Understand Your Tax Liability

This next part is crucial, and it’s where people sometimes get tripped up. The Residential Clean Energy Credit is a nonrefundable tax credit. What does that actually mean for you?

Let me explain. A tax credit directly reduces the amount of tax you owe, dollar for dollar. It’s way more powerful than a deduction. If you owe $6,000 in federal taxes and have a $5,000 solar credit, your new tax bill is just $1,000. Simple.

However, because it's nonrefundable, the credit can only reduce your tax liability to zero. You won’t get the leftover amount back as a cash refund. If your credit is $5,000 but you only owe $4,000 in taxes, you can't get that extra $1,000 back in cash that year.

So, what happens to that extra money? You don't lose it.

Step 4: Carry Forward Any Unused Credit

Here’s the good news: the IRS lets you carry forward any unused portion of your solar tax credit to the following tax year.

In our example, the remaining $1,000 of your credit would simply roll over. You can then apply it to reduce your tax liability in the next year, ensuring you eventually get the full value of the incentive you earned.

This carry-forward provision is a fantastic safety net. It guarantees that even if your tax bill in one year isn't large enough to absorb the full 30% credit, you won’t miss out on the savings you're owed. This feature makes the federal solar incentive a secure and valuable investment for homeowners with all sorts of financial situations.

While it's always smart to consult a tax professional for advice tailored to you, this process demystifies how you can confidently claim this powerful federal incentive.

Putting It All Together: A Real-World Savings Example

Let's move past the percentages and tax forms and tell a real story. Imagine a family in Salt Lake County looking at a pretty standard 6 kW solar system for their home. We’ll walk through their numbers to see how federal incentives turn a big upfront cost into a smart, long-term financial win.

This breakdown will show you the real cost, how the federal credit slashes that number, and how quickly the system pays for itself with the electricity it generates.

The Upfront Cost Before Incentives

Our Salt Lake County family gets a quote for a quality 6 kW solar system. Here in Utah, the average cost for a system that size—including all the parts, labor, and permits—hovers right around $18,000.

That initial number can feel like a gut punch. It’s a major home improvement project, no question. But that’s just the sticker price before any of the powerful financial tools come into play. For most homeowners, this is the first hurdle.

Applying the 30% Federal Tax Credit

Here’s where the math gets exciting. The family is eligible for the 30% Residential Clean Energy Credit, which is based on their total system cost of $18,000.

The calculation is straightforward: $18,000 x 0.30 = $5,400.

This $5,400 isn't a simple rebate. It's a direct, dollar-for-dollar reduction of what they owe in federal taxes for the year the system is turned on. It’s a huge deal.

This one incentive immediately cuts their net investment from $18,000 down to a much more manageable $12,600. This is the real number they need to recoup through energy savings, and it completely changes the financial outlook of the project.

This immediate, substantial reduction is the single biggest factor making solar accessible for families across Utah.

Projecting Monthly and Annual Energy Savings

Now that we know the true cost is $12,600, let's look at the return. This family’s 6 kW system is designed to wipe out most of their electricity bill. With average Utah electricity rates sitting around 11.5 cents per kilowatt-hour (kWh), those savings start adding up fast.

Their system should generate about 8,400 kWh of clean energy every year. That’s energy they don’t have to buy from the utility.

Here’s a quick breakdown of what that looks like in their wallet:

- Annual Electricity Savings: 8,400 kWh x $0.115/kWh = $966

- Average Monthly Savings: $966 / 12 months = $80.50

Suddenly, they are saving nearly $1,000 a year that would have otherwise gone straight to the power company. That consistent monthly saving provides immediate relief to their household budget and starts chipping away at their initial investment.

Calculating the Payback Period

The final piece of the puzzle is the payback period—the moment when the total energy savings have officially covered the net cost of the system. This is when the solar panels stop being an expense and start becoming a pure, profit-generating asset.

To figure this out, we just divide the net system cost by the annual savings:

$12,600 (Net Cost) / $966 (Annual Savings) = 13.04 years

So, after just over 13 years, the system will have entirely paid for itself.

Think about that. Modern solar panels have a performance warranty of 25 to 30 years. This means our family can look forward to another 12 to 17 years of virtually free electricity. That period represents thousands of dollars in pure profit, all generated quietly from their own roof. This is exactly how a solar investment pays off in the real world.

Why the Best Time to Act Is Now

Thinking about the utah solar tax credit can feel like you have plenty of time. In some ways, you do. The powerful 30% federal tax credit is firmly in place for now. But you know what? In the world of energy policy, stability is never guaranteed, and waiting might mean leaving serious money on the table.

Acting sooner rather than later is a smart financial move because it locks in today's known benefits against tomorrow's uncertainties. The current federal incentive is scheduled to remain at a strong 30% until 2032, but legislative changes can and do happen. Securing your solar installation now guarantees you get the maximum possible credit.

The Shifting Policy Landscape

Let me explain. While the step-down to 26% in 2033 seems far away, other factors can change the financial equation entirely. For example, some policy shifts have even suggested the 30% credit could end sooner than planned, potentially as early as December 31, 2025. This would create a sudden rush for installations and could leave latecomers with a smaller credit or none at all.

This isn’t just speculation; it's a real possibility based on how quickly energy policies can evolve. As Utah's solar market matures, generating up to 15-16% of the state's electricity, other changes are happening too. With the state's own RESTC now expired and new generation taxes being discussed, the current incentive environment is uniquely favorable. To learn more about how these deadlines are creating urgency for homeowners, you can discover more insights about federal solar tax credits on intermtnwindandsolar.com.

By acting now, you aren't just getting solar panels; you're securing a 30% return on your investment, guaranteed. The most valuable incentives are always the ones you can claim today, not the ones you hope will still be there tomorrow.

More Than Just Tax Credits

Beyond the federal incentive, other market factors are at play. Net metering policies, which determine how much your utility compensates you for the extra solar energy you send to the grid, are constantly under review. Locking in a favorable net metering agreement now can secure your savings for years to come.

These agreements can be just as valuable as the tax credit over the lifetime of your system. As more homes go solar, utilities often revise these programs, and the terms for new customers almost always become less generous. Getting your system installed and approved under today's rules is a strategic move to maximize your long-term return.

Another key consideration is pairing your solar system with other clean energy technology. Many Utah homeowners are also investing in electric vehicles to maximize their energy independence. In fact, we find that a professionally installed EV charging station is a common next step after going solar. You might be interested in our guide on Tesla EV charger installation to see how these technologies work together.

Ultimately, the present moment offers a perfect combination of factors: a peak federal tax credit, stable net metering policies, and mature, affordable technology. Waiting introduces risks—the risk of a reduced credit, less favorable utility terms, and potential price increases. The message is simple: the financial ground is solid right now, making it the ideal time to make your move.

Partnering with an Expert for Your Solar Journey

Let's be honest. Navigating solar incentives, permits, and the actual installation feels like a lot. This is where leaning on a licensed and experienced electrical contractor like Black Rhino Electric really changes the game. A professional team does a lot more than just bolt panels to your roof.

We’re here to make sure your system is sized right for your home's energy appetite, not your neighbor's. We also double-check that your main electrical panel can safely handle the new power—a critical step that keeps things efficient and up to code. And, of course, we’ll walk you through every detail of the Utah solar tax credit and local utility programs, so you don't leave a single dollar on the table.

Why Professional Installation Matters

A quality installation protects your home and makes sure you get the most out of your investment for decades. Here’s how a certified electrician safeguards your solar project:

- Code Compliance: We live and breathe local and national electrical codes. This isn't just about passing an inspection; it's about preventing safety hazards down the road.

- System Sizing: We run a detailed load calculation to design a system that actually matches your energy use. This means you aren’t overspending on panels you don’t need.

- Panel Health: We’ll verify your existing electrical panel is up to the task. If an upgrade is needed for safety and performance, we'll explain exactly why, but we only recommend it when it’s truly necessary.

Choosing a professional installer isn't just about getting panels on the roof; it's about building a safe, efficient, and reliable power plant for your home that delivers savings for decades.

We believe in clear communication and transparent pricing to make the whole process feel straightforward and stress-free. If you’re ready to take full advantage of the current tax credits and finally shrink those power bills, it’s time to talk to an expert.

Frequently Asked Questions About Utah Solar Credits

When you start digging into the Utah solar tax credit, a lot of the same questions tend to pop up. It's a big decision for your home and finances, so getting straight answers is the only way to move forward feeling confident. Let me walk you through some of the most common questions we hear from homeowners across Weber, Davis, and Salt Lake counties.

Getting these details right is the key to maximizing your savings and making a smart investment.

Can I Claim the Solar Tax Credit If I Don't Owe Federal Taxes?

This is a fantastic and really important question. The short answer is that you need to have a federal tax liability to actually benefit from the Residential Clean Energy Credit. It’s a nonrefundable credit, which means it can knock your tax bill down to zero, but the IRS won't send you a check for any leftover amount.

However—and this is the crucial part—you don't lose the value. If your credit is bigger than what you owe in the year you install the system, you can carry the unused portion forward to lower your taxes in future years. This makes sure you eventually get the full value of the credit you earned.

Does the Federal Tax Credit Cover Home Battery Costs?

Yes, it absolutely does, and this is a game-changer for anyone looking for real energy independence. If you install a battery storage system at the same time as your solar panels, the battery's full cost is eligible for the same 30% credit.

Here's the thing: you can also claim the credit if you decide to add a battery to an existing solar system down the road. As long as the battery has a capacity of 3 kWh or more, it qualifies. This makes pairing solar with storage more affordable than ever, letting you keep the lights on even when the grid goes down.

Do I Need to Be a Tax Expert to File for the Credit?

Not at all. While IRS forms can look a little intimidating at first glance, the process itself is pretty straightforward for most homeowners. You’ll just need to complete and file IRS Form 5695 along with your regular federal tax return, like your Form 1040.

Most popular tax software will walk you through it with simple questions. That said, if your financial situation is particularly complex, checking in with a qualified tax professional is always a wise move to make sure everything is filed correctly. For more answers on how we handle things, feel free to check out our company's FAQ page.

Are Other Local Utility Rebates Available in Utah?

This is where things can get very specific to your exact address. While the big federal credit gets most of the attention, some local utilities might offer their own separate rebates or incentives.

Local utility rebates can vary a lot and change pretty often. Programs from providers like Rocky Mountain Power or smaller municipal utilities might include rebates for solar, battery storage, or even installing an EV charger.

Your best bet is to check directly with your specific utility provider to see what programs they have running right now. A professional solar installer stays on top of these local incentives and can be a great resource for spotting extra savings in your area.

At Black Rhino Electric, we're committed to giving you transparent answers and expert guidance through your entire solar journey. If you’re ready to see how solar could work for your home, request a free quote or give our team a call at 385-396-7048 today.