Imagine plugging your EV in at home, knowing you just pocketed a serious discount on the installation. That’s the real power of the ev charger installation tax credit, a federal incentive designed to make the switch to electric that much easier on your wallet. This isn't some tiny rebate; it's a powerful credit that directly chips away at your tax bill, making a home charger more accessible than ever.

Contents

- 1 Understanding the Federal EV Charger Tax Credit

- 2 Confirming Your Eligibility for the Credit

- 3 A Step-by-Step Guide to Claiming Your Credit

- 4 Stacking Your Savings with Utah and Utility Incentives

- 5 Why Professional Installation Is Crucial for Tax Credit Claims

- 6 Your EV Charger Installation Plan with Black Rhino Electric

- 7 Frequently Asked Questions

Understanding the Federal EV Charger Tax Credit

Let me explain. When you hear about financial incentives, it's easy to get lost in the jargon. But the federal government offers one key benefit every potential EV owner in Utah should know about.

The official name is the Alternative Fuel Vehicle Refueling Property Credit. Think of it as the government’s primary tool for helping you offset the cost of getting your home ready for an electric vehicle.

You’ll file for this incentive using IRS Form 8911, and honestly, it’s a game-changer for homeowners. The best part? It covers 30% of the total cost, up to a maximum of $1,000. That's a substantial saving that can make a real dent in your initial investment.

Tax Credit vs. Tax Deduction: What’s the Difference?

This is where many people get tripped up, but the distinction is crucial for understanding your actual savings. A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe.

Think of it this way: a deduction lowers the amount of your income that gets taxed in the first place. A credit, on the other hand, is like handing the IRS a coupon to pay your final tax bill.

A tax credit is a dollar-for-dollar reduction of your income tax liability. If you owe $3,000 in taxes and have a $1,000 tax credit, your new tax bill is just $2,000. This makes it far more valuable than a deduction for most people.

Because the EV charger incentive is a credit, it provides a much more direct and impactful financial benefit. It’s a powerful way to make your home charging setup more affordable right from the start.

What Costs Are Actually Covered?

So, what exactly can you apply this 30% credit to? The good news is the IRS allows you to include both the equipment and the installation costs. Here’s a simple breakdown of what typically qualifies:

- The EV Charger Itself: The purchase price of your Level 2 charging station, whether it's a Tesla Wall Connector or another popular brand.

- Labor and Installation Fees: The cost of hiring a licensed electrician, like the experts at Black Rhino Electric, to perform the installation is covered.

- Necessary Electrical Upgrades: If your home needs a new circuit, upgraded wiring, or even a panel upgrade to support the charger, these "make-ready" costs are generally included.

- Permitting Fees: Any fees required by your local municipality to approve the installation are also eligible.

What Is Not Covered by the Credit

It’s just as important to know what you can't claim. The credit is specifically for the refueling property and its direct installation.

This means the credit does not cover the cost of the electric vehicle itself—that’s a separate tax credit with its own set of rules. The focus here is solely on the infrastructure that gets your home ready for charging. Knowing this ahead of time helps you accurately calculate your potential savings and avoid any surprises when tax season rolls around.

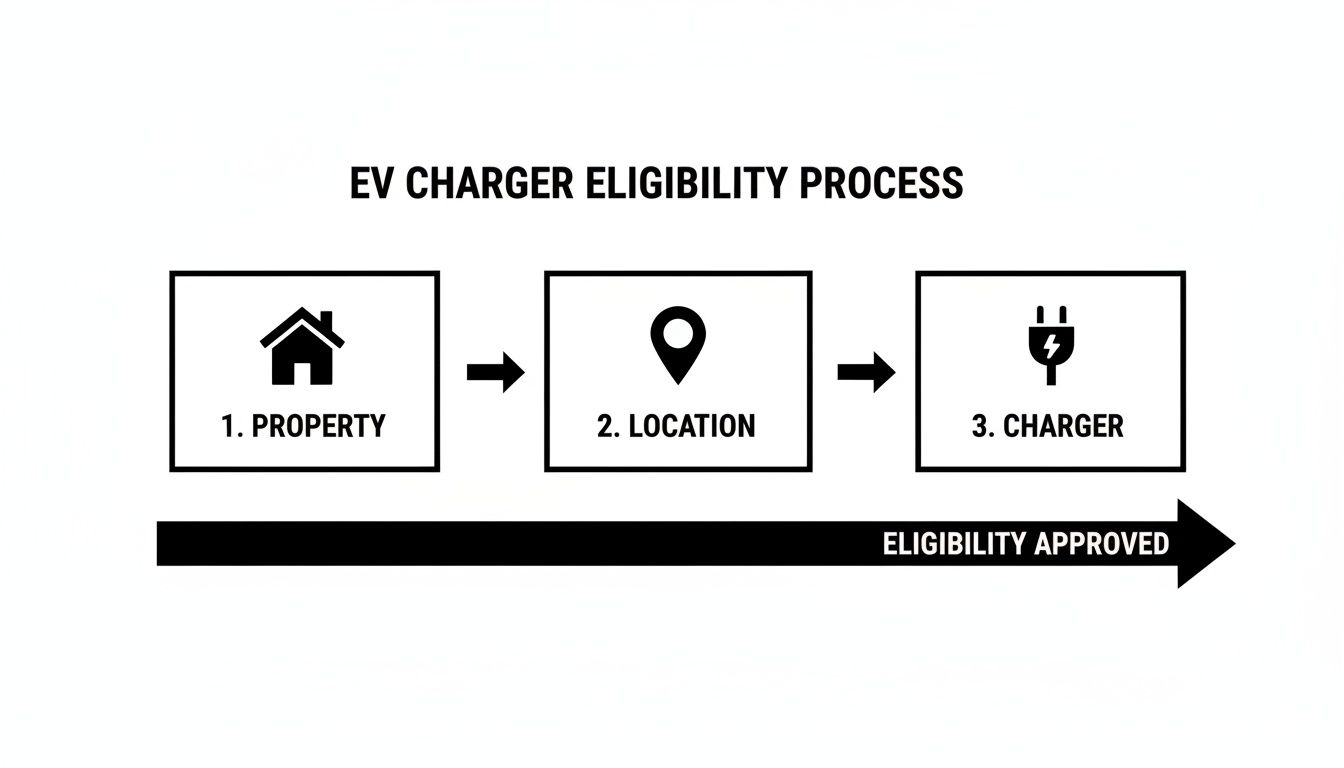

Confirming Your Eligibility for the Credit

Knowing about the ev charger installation tax credit is one thing, but making sure your project actually qualifies is where the rubber meets the road. Before you even pick out a charger, you need to be certain you meet all the requirements set by the IRS. This isn't just about saving a few bucks—it's about making sure your investment pays off exactly like you planned.

Let me break down the criteria for homeowners and for businesses. While both can get a piece of the pie, the rules they have to follow are pretty different.

Eligibility for Homeowners

For a regular residential installation, the rules are refreshingly simple. The biggest requirement is that the charger must be installed at your primary residence. That means the home where you live most of the year; vacation homes or that rental property you own generally won't qualify for this specific credit.

Also, the charger has to be "placed in service" during the tax year you're claiming the credit for. In plain English, this just means the charger needs to be fully installed and working before the end of the year.

Here’s a quick checklist to see if you're on the right track:

- Primary Residence: The installation address has to be your main home.

- New Equipment: The credit is for new charging equipment, not used or pre-owned units you found online.

- Installation Timeline: The charger must be installed and ready to go within the correct tax year.

Business and Commercial Project Requirements

For businesses, the rules get a bit more complex, but the potential reward is much, much bigger. The federal government's Alternative Fuel Infrastructure Tax Credit (Section 30C) has been a game-changer, offering businesses up to a 30% tax credit or a whopping $100,000 per EV charging port for qualified installations.

But there's a catch, and honestly, it's a detail many people miss. The credit requires the property to be located in designated low-income or non-urban census tracts. This is all about promoting equity in EV access, not just adding chargers to already well-served areas. You can learn more about how federal incentives are structured for commercial properties to make sure you maximize your return.

Key Takeaway: For businesses, location is everything. The federal government uses specific mapping tools to decide which areas qualify, aiming to expand charging access beyond just affluent urban centers.

This whole process is designed to remove the guesswork so you can be confident your project qualifies from day one. Before you do anything else, you have to verify your address. The IRS provides links to mapping tools that let you punch in your property’s address and see instantly if it falls within a qualifying low-income community or non-urban area.

Technical Standards for Your EV Charger

Finally, whether your project is for your home or your business, the charging equipment itself has to meet certain technical standards. The credit is designed for qualified Level 2 chargers or DC fast chargers—these are the more powerful stations that need a professional to install them on a 240-volt circuit.

Your charger also needs to be capable of bidirectional charging. This allows it to both charge your car and, in the future, potentially send power back to the grid. While not every homeowner will use this feature today, it’s a forward-looking requirement. It ensures the equipment being installed supports a modern, resilient energy grid.

Working with a knowledgeable installer like Black Rhino Electric guarantees your chosen charger is fully compliant with all the technical and safety standards, so you don't have to worry about the fine print.

A Step-by-Step Guide to Claiming Your Credit

Let’s be honest, dealing with tax forms isn't anyone's idea of a good time. But we're here to make sure claiming your EV charger installation tax credit is as painless as possible. Think of this as your roadmap to getting the money you’re entitled to, from organizing the paperwork to filing the right forms. We'll make sure you don't leave a single dollar of savings behind.

Claiming the federal credit really boils down to two things: good record-keeping and filling out one specific form correctly. It’s not designed to trip you up, but skipping a step can lead to delays or even put your credit at risk.

The whole process kicks off the day your installation wraps up and finishes when you file your yearly taxes. Stick with these steps, and you’ll be able to navigate it confidently and lock in the full $1,000 residential credit.

Step 1: Gather Your Essential Paperwork

Before you even open your tax software, your first move is to pull together all the documents from your EV charger installation. The IRS needs to see proof of what you spent, so having everything organized is a must.

When you work with Black Rhino Electric, we simplify this by giving you a detailed, itemized invoice. This is your most important piece of paper. It breaks down the cost of the charger itself, our labor, and any electrical upgrades we had to do, like running a new circuit or making adjustments to your panel.

The paperwork is your proof, plain and simple. Here’s a quick checklist of what you'll want to have on hand when it’s time to file.

Essential Documents for Claiming Your Tax Credit

Use this checklist to gather the necessary paperwork for successfully filing IRS Form 8911 and claiming your credit.

| Document | What It Should Contain | Why You Need It |

|---|---|---|

| Installer's Invoice | Itemized costs for equipment, labor, and electrical upgrades. Installer’s business name and address. Date of service. | This is your primary proof of the total qualified expenses. It separates hardware from labor costs. |

| Proof of Payment | Canceled check, credit card statement, or bank transfer record showing the payment to the installer. | Confirms you actually paid the amount shown on the invoice. It links the expense directly to you. |

| Charger Purchase Receipt | If you bought the hardware separately, the receipt showing the model, cost, and purchase date. | Substantiates the cost of the charger itself if it's not included on the main installation invoice. |

| Property Ownership Proof | A utility bill or property tax statement with your name and the installation address. | Verifies the charger was installed at your primary residence, a key eligibility requirement. |

Having these documents saved in a folder—digital or physical—will make tax time much smoother.

Step 2: Complete IRS Form 8911

With your receipts and invoice ready, it’s time for the main event: filling out IRS Form 8911, the Alternative Fuel Vehicle Refueling Property Credit. This is the one-page form where you officially calculate and claim your credit.

Here’s a quick rundown of what you’ll do:

- Part I: This section is for your home. You’ll put down the address where the charger was installed and the date it was officially up and running.

- Cost Calculation: You'll enter the total cost of your charger and the installation. The form walks you through calculating 30% of that total.

- Credit Limit: The form automatically caps your credit at the $1,000 maximum for a residential installation, so you don't have to worry about that part.

This form isn’t filed by itself. It gets attached to your main federal tax return (like Form 1040). The final credit amount from Form 8911 gets carried over to the right line on your 1040, which directly lowers the amount of tax you owe.

Step 3: Understand Key Deadlines

With taxes, timing is everything. To claim the EV charger credit, the equipment has to be "placed in service"—which just means fully installed and working—during the tax year you're filing for.

For example, if we finish your installation in November 2024, you'll claim the credit on the tax return you file in early 2025. If the work gets done in January 2025, you'll have to wait to claim it on your 2025 taxes, which you'll file in 2026.

The filing deadline is usually April 15th. Make sure you have all your paperwork and forms done well before then to avoid a last-minute scramble. Missing that window could mean missing out on your savings entirely.

Stacking Your Savings with Utah and Utility Incentives

The federal government's incentive is fantastic, but what if I told you it’s often just the tip of the iceberg? Getting the federal ev charger installation tax credit is a great start, but savvy Utah residents can often stack additional savings from state and local utility programs. This is how you turn a good deal into an incredible one, dramatically lowering your out-of-pocket costs.

Here’s the thing: while the federal government sets broad goals, local utilities are on the front lines, actively encouraging EV adoption right here in our communities. They do this by offering direct rebates and special programs that you can combine with your federal tax credit.

Uncovering Local Rebates from Utility Providers

For many homeowners in Northern Utah, the most significant local incentives come directly from their electricity provider. Companies like Rocky Mountain Power are key players in our state's transition to cleaner energy, and they often provide financial perks to customers who install Level 2 chargers.

These programs are designed to be straightforward and can make a real difference in your total project cost.

- Direct Rebates: Some utilities offer a fixed-dollar rebate for purchasing and installing a qualified Level 2 EV charger. This is cash back in your pocket, separate from the federal tax credit.

- Time-of-Use (TOU) Rate Plans: Many providers offer special electricity rates for EV owners. These plans drastically lower the cost per kilowatt-hour during off-peak times, like overnight, making your daily "fueling" incredibly cheap.

- Installation Support: Occasionally, programs may even offer incentives to help cover the costs of electrical upgrades needed for your new charger, such as panel work.

For example, Rocky Mountain Power has historically offered rebates and programs for both residential and commercial customers. These incentives can change, so it's always best to check their official website for the most current offers available in your specific area. Layering a utility rebate on top of the federal credit can sometimes cut the cost of a new charger in half.

The Bigger Picture of EV Infrastructure

This local push is part of a much larger national effort to build out a reliable charging network. The Bipartisan Infrastructure Law allocates $7.5 billion to expand charging infrastructure, targeting highways and rural areas to help the country hit a goal of 50% EV sales by 2030.

Level 2 chargers—the kind Black Rhino Electric specializes in for home and workplace use—are the backbone of this strategy, with projections showing over 5.5 million units will be installed globally by 2026. You can explore more data on the growth of the EV charger market to see just how rapidly this technology is expanding.

By taking advantage of local programs, you're not just saving money; you're participating in a nationwide movement to make EV ownership practical and accessible for everyone. It’s a win for your wallet and a win for the community.

While Utah's state-level incentives for EV chargers can fluctuate from year to year, it’s always worth checking for any active programs. State tax credits or rebates, when available, can be another powerful layer to add to your savings stack.

These programs are typically managed by state energy offices or environmental quality departments. Keeping an eye on their official websites is the best way to stay informed about any new or renewed incentives that could benefit your installation project.

Applying for these local incentives is usually separate from filing your federal taxes. Most utility and state programs have their own online application portals where you'll need to submit copies of your receipts and your installer's invoice. This is another reason why the detailed, professional documentation provided by Black Rhino Electric is so important—it gives you exactly what you need for a smooth application.

Why Professional Installation Is Crucial for Tax Credit Claims

It’s tempting to think about a DIY installation to save a few dollars upfront, but when thousands in savings are on the line, that can be a seriously costly mistake. Securing the EV charger installation tax credit and other local rebates hangs on getting the installation right from the start.

Here’s the thing, bringing in a licensed electrical contractor isn't just a good idea—it's essential for both your wallet and your peace of mind.

A professional install ensures your project meets all national and local electrical codes, which is a non-negotiable requirement for pretty much every incentive program out there. The IRS and your utility company simply won't approve credits for work that isn't compliant. Why? Because non-compliant work is a major safety risk.

Ensuring Code Compliance and Safety

The National Electrical Code (NEC) has specific, detailed rules for EV charger installations, covering everything from the right circuit loads to proper grounding. On top of that, local Utah municipalities often add their own requirements.

A licensed electrician from Black Rhino Electric knows these complex regulations inside and out. We make sure every part of your installation is perfect, which is critical for two big reasons:

- Safety First: An improper installation can lead to electrical fires, damage your vehicle's battery, and even void your home insurance policy.

- Credit Eligibility: Most applications for these incentives require proof that the work was done by a licensed professional and passed a final inspection.

Without that professional sign-off, your application for a tax credit or a utility rebate will almost certainly be rejected.

The Paperwork Trail The IRS Demands

Beyond the safety and code compliance, the most direct reason to hire a pro is the documentation. The IRS needs a clean, clear paper trail to approve your claim, and a simple receipt from a big-box store just won't cut it.

When you work with us, you get an itemized invoice that clearly separates the costs of:

- The EV charger hardware itself

- The labor for the installation

- Any necessary electrical upgrades, like a new circuit or panel work

This detailed documentation is exactly what you need when you sit down to fill out Form 8911. It provides indisputable proof of your qualified expenses, leaving no room for the IRS to question your claim and making the filing process smooth.

This professional approach is a core part of how we operate—it protects your home, your investment, and your ability to claim these valuable savings. This is becoming even more important as the U.S. government invests heavily in EV infrastructure. In fact, $7.5 billion from 2021's Infrastructure Act is set to build out over 500,000 public chargers, while residential installations are forecasted to hit 28 million by 2030. You can learn more about how these infrastructure bills are shaping the future of EV charging.

Our expertise in everything from panel upgrades to Tesla Wall Connectors means our Northern Utah clients can capitalize on these incentives before they disappear. To make sure your home is ready, you can explore the details of our residential EV charger installation services and see how we guarantee a compliant and fully documented setup.

Your EV Charger Installation Plan with Black Rhino Electric

Ready to bring fast, convenient EV charging home? Getting that EV charger installation tax credit starts with a professional, well-documented project. Our process is simple and transparent, making sure you have every piece of paper you need. It all begins with a real conversation and a look at your property, where we’ll help you pick the right Level 2 charger for your car and your garage.

We handle all the heavy lifting. That means the complex wiring, running a new dedicated circuit, and sorting out any electrical panel upgrades that might be necessary. You know what? Our job isn't done until the installation is clean, safe, and passes every local code with flying colors.

Our Transparent Process

When you work with us, you get more than just an installation; you get a partner. We provide the detailed, itemized invoices required for your tax credit applications and make sure every part of the job is documented correctly. It’s a meticulous approach, but it’s how we protect your investment and make sure you get the maximum savings you're entitled to.

Our process is built for your peace of mind:

- Initial Consultation: We’ll talk about your charging needs, what kind of EV you drive, and your daily routine.

- Site Assessment: Our electricians will evaluate your home's electrical system to map out the safest, most efficient installation plan.

- Clear Estimate: You get a detailed quote with no hidden fees, breaking down all the costs for equipment and labor.

- Professional Installation: We complete the work to the highest safety standards, ensuring everything looks and works perfectly.

To kick off your project with a team that puts quality and safety first, you can see how straightforward our process is when you request a quote. We’ll give you a clear estimate and guide you every step of the way, making your switch to electric smooth and financially smart.

Frequently Asked Questions

When you're digging into tax credits and rebates, the details matter. It's natural to have questions about the fine print on something like the ev charger installation tax credit, especially when planning your budget. We hear a lot of the same questions from homeowners, so we’ve gathered the most common ones right here to give you some clear answers.

Let's walk through those "what if" scenarios and clear up the tricky parts of the credit.

Can I Claim the Credit for a Charger at My Vacation Home?

This is a really common point of confusion, but the rule here is straightforward. The federal tax credit for residential chargers applies only to your primary residence—the home where you live most of the year.

The whole point of the credit is to help homeowners get their main home ready for an EV. The rules are completely different for businesses installing chargers at commercial properties or rentals, so it's always smart to talk with a tax pro about your specific situation.

Does the Tax Credit Cover an Electrical Panel Upgrade?

Yes, in most cases, it absolutely does. The credit isn't just for the charger itself; it's designed to cover the "make-ready" costs needed to get the charger installed and running safely.

If your home needs an electrical panel upgrade to handle the new EV charger, the costs for that work are generally eligible to be included in your total. Here at Black Rhino Electric, we provide a detailed quote that breaks everything out, giving you the clean documentation you'll need for your tax records. For more answers to common electrical questions, you can check out our comprehensive Black Rhino Electric FAQ page.

What if I Install My Charger but Forget to File for the Credit?

Don't panic. If you missed claiming the credit in the year you had the charger installed, you can usually file an amended tax return to claim a credit you overlooked.

You generally have three years from the date you filed your original return to make corrections and claim a missed credit. We always recommend speaking with a tax advisor to confirm the exact process and deadlines for your situation.

This little safety net means you don't permanently lose out on the savings you're entitled to.

Is the EV Charger Credit a Refundable Credit?

No, the Alternative Fuel Vehicle Refueling Property Credit is a nonrefundable tax credit. This is a key detail that affects how much you actually save.

A nonrefundable credit can reduce your tax liability all the way to zero, but you won't get any of it back as a cash refund if the credit is more than what you owe. For example, if your tax bill is $800 and your credit is $1,000, the credit will wipe out your bill, but you won't get the remaining $200 back in your pocket.

At Black Rhino Electric, our goal is to make your switch to EV charging as smooth and affordable as it can be. If you're ready to get started with a team that delivers expert work and the clear documentation you need for all the available incentives, give us a call at 385-396-7048 or request a free quote today.