Navigating the world of electrical work is complex enough without worrying about what could go wrong. Honestly, understanding the electrical contractor insurance requirements for your business is one of the most critical steps you can take. It’s not just a legal formality; it's the financial armor that protects your livelihood from the everyday risks of the job.

Running an electrical business means you're dealing with high-stakes projects every single day. A single mistake isn't just a do-over; it can be catastrophic. So, what's standing between a minor mishap on the job site and a lawsuit that could shutter your business for good? It all comes down to having the right insurance in place to protect your finances, your clients, and the reputation you've worked so hard to build.

Contents

- 1 Why Your Business Depends on the Right Insurance

- 2 The Four Core Policies Every Electrician Needs

- 3 Specialized Coverage to Fill the Gaps

- 4 Navigating State and Local Insurance Mandates

- 5 Managing Your Certificates of Insurance

- 6 Your Action Plan for Getting the Right Coverage

- 7 Frequently Asked Questions

Why Your Business Depends on the Right Insurance

Honestly, one of the biggest mistakes I see contractors make is viewing insurance as just another overhead cost. That’s a dangerous mindset. Think of it less like a monthly bill and more like a suit of armor for your company.

Every time you or your crew steps onto a job site, you face real risks—from accidentally drilling into a water pipe to a severe injury. Without the right coverage, you are personally on the hook for every potential accident. Is that a weight you're really prepared to carry?

Let me explain. Imagine a simple wiring mistake causes a power surge that completely fries a client's expensive home theater system and smart home setup. A solid general liability policy handles the replacement costs. But without it? That five-figure bill comes straight out of your business's bank account, or worse, your personal savings.

To help you get a handle on what you truly need, here’s a quick rundown of the essential policies that form the foundation of a well-protected electrical business.

Quick Overview of Essential Contractor Insurance

This table breaks down the core insurance policies every electrical contractor should consider to meet both legal and client expectations.

| Insurance Type | What It Covers | Why It's Critical |

|---|---|---|

| General Liability | Third-party property damage, bodily injury, and advertising injury. | The absolute bedrock. It protects you from everyday job site accidents. |

| Workers' Compensation | Employee medical bills and lost wages from on-the-job injuries. | Required by law in most states if you have employees. Non-negotiable. |

| Commercial Auto | Accidents involving your work vans and trucks. | Personal auto policies won't cover business use. This fills that crucial gap. |

| Tools & Equipment | Theft of or damage to your valuable tools, whether on-site or in transit. | Protects the expensive gear you need to actually do your job. |

| Professional Liability | Financial losses from errors in your work, design, or advice. | Covers mistakes that don't cause physical damage but still cost the client money. |

| Umbrella Liability | Additional coverage that kicks in when other policy limits are exhausted. | A vital safety net for catastrophic, high-cost claims. |

This isn't an exhaustive list, but these are the policies that address the most common and costly risks you'll face.

The Real Cost of Being Uninsured

You know what? The financial fallout is just one piece of the puzzle. Being uninsured or underinsured creates a massive trust problem. Think about it from the client's perspective: would you hire an electrician who couldn't prove they could cover potential damages to your home? Of course not. Proper insurance is a non-negotiable sign of professionalism that savvy clients and general contractors actively look for.

This growing demand for protection is being felt across the industry. The electrical contractor insurance market, currently valued at $9.2 billion, is projected to climb to $16.7 billion by 2033. What's driving this? Stricter regulations and the increasing complexity of modern projects, from intricate smart home installations to commercial renewable energy systems. You can discover more insights about this expanding market on marketintelo.com.

Key Takeaway: As an experienced professional in this field, I can tell you that insurance isn't just about compliance; it's a fundamental business tool that safeguards your assets, builds client confidence, and enables sustainable growth in an increasingly complex industry.

Ultimately, meeting the right electrical contractor insurance requirements is the bedrock of a resilient business. It gives you the peace of mind to focus on your craft, knowing you’re protected when the unexpected—inevitably—happens.

The Four Core Policies Every Electrician Needs

Navigating business insurance can feel like learning a new language, but it doesn't have to be that complicated. Honestly, it all boils down to four foundational policies every single electrician should have. Getting the electrical contractor insurance requirements right starts with understanding this core four is the essential framework for protecting your livelihood.

Think of these policies as the four walls of your business’s financial safety net. Each one is designed to protect you from a different, yet equally real, type of risk you face out on the job. Let's break them down one by one.

1. General Liability Insurance

You know what? This is the big one. General Liability is the absolute bedrock of your insurance. Think of it as your primary shield against claims that your work caused bodily injury or property damage to someone else—like a client, a visitor, or another contractor.

Let me explain with a real-world scenario. Imagine your apprentice is carrying a ladder through a client’s home and accidentally knocks over an expensive antique vase. Or worse, a homeowner trips over an extension cord you left on the floor and breaks their wrist. Without general liability, the cost for medical bills or replacing that vase comes directly from your pocket. With it, the policy is there to cover those expenses, including legal defense if it turns into a lawsuit.

Here are the key situations where General Liability comes into play:

- Property Damage: Covering the cost to repair or replace a client's property that you or your team accidentally damaged.

- Bodily Injury: Paying for medical expenses if a non-employee is injured because of your work.

- Advertising Injury: Protecting you from claims of libel, slander, or copyright infringement in your marketing.

2. Workers’ Compensation Insurance

If you have even one employee, this policy isn't just a good idea—it's the law in most states. Workers' Compensation is designed to protect your most valuable asset: your team.

It provides a critical safety net for employees who get injured or fall ill as a direct result of their job. This coverage pays for their medical bills, a portion of their lost wages while they recover, and rehab costs. For example, if an electrician on your crew suffers a severe electric shock or falls from a ladder, this policy handles the aftermath.

But here’s the thing: it also protects you. By providing these benefits, workers' comp generally prevents an injured employee from suing your business over the injury, which could otherwise lead to a financially devastating lawsuit.

Expert Insight: In a physically demanding trade like electrical work, where the risk of injury is always present, robust workers' compensation isn't just a legal necessity. It is a moral one that shows you're committed to your team's well-being and fosters a safer, more loyal workforce.

3. Commercial Auto Insurance

That work van or truck with your company logo on the side? Your personal auto policy won’t cover it for business use. This is a common and costly mistake many new contractors make. If you or an employee gets into an accident while driving to a job site or picking up supplies, your personal insurance can deny the claim entirely, leaving you on the hook.

Commercial Auto insurance is specifically built for vehicles used for work. It provides coverage for:

- Liability for bodily injury or property damage you cause to others in an accident.

- Collision coverage for damage to your own vehicle.

- Protection against theft or vandalism of your work truck.

4. Professional Liability Insurance (Errors & Omissions)

Finally, let's talk about Professional Liability, often called Errors & Omissions (E&O) insurance. This is different from General Liability. While General Liability covers accidents that cause physical damage or injury, Professional Liability covers financial losses a client suffers because of a mistake in your professional services or advice.

Here’s the thing: not all mistakes cause immediate, visible damage. What if you designed a lighting system for a commercial client, but an error in your load calculations causes recurring circuit overloads? That could lead to business downtime and lost revenue for them, and they could sue you for those financial losses.

This is precisely where E&O insurance steps in. It protects you from claims related to:

- Faulty design: A wiring layout that proves to be inefficient or non-compliant.

- Negligent advice: Incorrectly advising a client on a panel upgrade, causing them to spend more money later.

- Oversights: Forgetting a critical component in a project plan that leads to financial harm for the client.

Together, these four policies form a robust shield, protecting your business from the most common risks you face every single day. Understanding them is the first step in building a business that lasts.

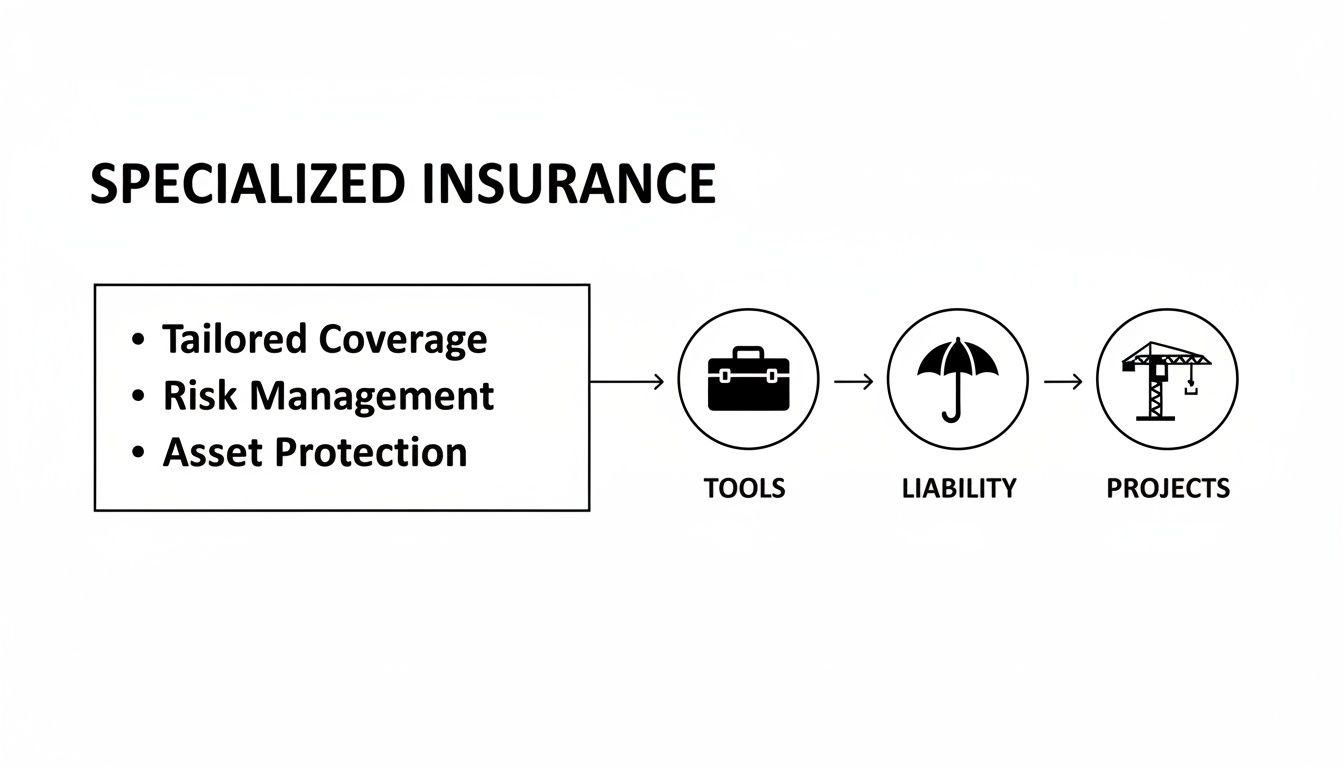

Specialized Coverage to Fill the Gaps

Once you’ve got the four core policies locked down, you’ve built a solid foundation. But what about the risks that fall between the cracks of those big policies? This is where digging into more specialized electrical contractor insurance requirements really pays off, filling in the gaps that can leave your business wide open to trouble.

Honestly, the difference between a minor hiccup and a full-blown financial crisis often comes down to these extra layers of protection. Think of them as custom-fit armor for the unique risks your electrical business takes on, especially on bigger, more complex jobs.

Protecting Your Most Valuable Assets with Inland Marine Insurance

Ever stop and think about what protects your expensive tools and equipment once they leave the shop? Most standard property insurance policies only cover items at a single, fixed address. For an electrician whose gear is always on the move, that’s a huge problem.

Let me explain. Inland Marine insurance, which most of us just call Tools and Equipment coverage, was designed for exactly this situation. It protects your property while it's in your truck, on a job site, or stored somewhere temporarily.

Picture these all-too-common scenarios:

- Your work van gets broken into overnight, and thousands of dollars in power tools and testers are gone.

- A pallet of high-end lighting fixtures you’re responsible for gets crunched by a forklift on a chaotic construction site.

- A surprise downpour floods a basement where you’ve staged your gear, wrecking sensitive diagnostic tools.

Without this coverage, you're on the hook for replacing everything out of pocket. With Inland Marine insurance, you can get back to work without that devastating financial hit. It’s an absolute must-have for any contractor whose tools are their livelihood.

Adding an Extra Layer of Security with Umbrella Insurance

What happens if a catastrophic lawsuit blows past the limits of your General Liability or Commercial Auto policy? Are you ready to pay the difference yourself? That’s a terrifying thought for any business owner.

This is exactly where Umbrella Insurance steps in. It’s not a primary policy; instead, it’s like a giant safety net that sits on top of your other liability policies, waiting for a worst-case scenario.

An Umbrella policy kicks in with additional liability coverage—often an extra $1 million or more—but only after your primary policy limits have been completely maxed out. It’s a surprisingly affordable way to get high-level protection against a claim that could otherwise sink your business.

For instance, if you’re found liable for a major accident that causes $1.5 million in damages, but your General Liability policy tops out at $1 million, your Umbrella policy would cover the remaining $500,000. For a growing business, that’s the ultimate peace of mind.

Specialized Policies for Unique Projects

Beyond tools and extra liability, some jobs just demand their own specific types of protection. The two you'll run into most often are Builder's Risk and Surety Bonds.

Here’s a quick rundown of how they work and when you’d need them:

| Coverage Type | What It Does | When You Need It |

|---|---|---|

| Builder's Risk Insurance | Protects a structure and the materials on-site during the construction process from things like fire, theft, or vandalism. | A must when you're working on new construction or a major renovation. It covers the building itself before the project is finished. |

| Surety Bonds | A three-way agreement guaranteeing you'll finish the project according to the contract. It’s a guarantee of performance, not typical insurance. | Often required to even bid on large government or commercial projects. It tells the project owner you’ll deliver on your promises. |

Getting a handle on these specialized policies is a game-changer, especially as you start bidding on bigger and more complex work. For example, making sure all your subs are properly insured is a key part of risk management on large-scale jobs—it's standard practice for experienced commercial electrical contractors in Northern Utah. Having these coverages in place shows a high level of professionalism and risk awareness, making your company a much more attractive partner for general contractors and high-value clients.

Here’s the thing about insurance: the rules aren’t the same everywhere. What’s required in one county might be completely different just a few miles down the road. Understanding your local and state-level electrical contractor insurance requirements isn’t just about satisfying a client contract; it’s about the fundamental legal right to run your business.

Many state licensing boards won't even talk to you about a license until you can show them proof of specific insurance policies. Honestly, it makes perfect sense. They need to know you have the financial muscle to cover potential damages before they sign off on you working inside homes and businesses.

Think of it like this: each policy is a specialized tool. You wouldn't use a voltmeter to hammer a staple, and you wouldn't rely on general liability to protect your commercial van. Each piece of your coverage plan has a specific job to do.

Decoding State Licensing Board Rules

So, where do you start? Your first and most important stop should always be the official website for your state's electrical contractor licensing board. This is where you'll find the non-negotiable, absolute minimum coverage you have to carry.

These requirements often change depending on the type of license you hold. A state might have a few different tiers, for example:

- Limited License: Often for smaller jobs (say, under $60,000) and might only require a basic general liability policy.

- Intermediate License: For bigger projects, this level could add a surety bond to the general liability requirement.

- Unlimited License: For projects of any size, this will almost certainly demand higher liability limits, a beefy surety bond, and mandatory workers' compensation.

It’s on you, the business owner, to know these rules inside and out. Pleading ignorance won't get you out of fines or a suspended license.

Key Takeaway: State mandates are not suggestions; they are the legal floor for your insurance coverage. Always verify the specific requirements for your license type directly with your state's licensing authority.

How Your Business Structure Affects Requirements

Let me explain another key factor: how you've set up your business. The rules for a solo operator are often very different from those for an LLC with a crew of ten.

A sole proprietor might get by with just general liability. But the second you hire your first employee, most states legally require you to carry workers' compensation insurance. This isn't optional—getting caught without it can lead to severe penalties, including crippling fines and even stop-work orders.

The scale of your work matters, too. Electrical faults are a factor in 15% of all U.S. property damage claims. And with catastrophic events like floods and fires becoming more common, there's a staggering 60% protection gap in disaster recovery, according to recent industry research. You can read the full research on global insurance gaps at aon.com. Robust, mandated coverage isn't just about protecting your business; it’s a critical part of community safety.

To give you a clearer picture, here are some common liability limits you'll see requested by clients and required by licensing boards.

Typical Coverage Limits for Electrical Contractors

| Insurance Type | Common Minimum Limit | Recommended Limit for Larger Jobs |

|---|---|---|

| General Liability | $1,000,000 per occurrence | $2,000,000 per occurrence |

| Commercial Auto | $500,000 combined single limit | $1,000,000 combined single limit |

| Umbrella Liability | $1,000,000 | $5,000,000 or more |

At the end of the day, staying compliant means doing your homework. Check with your state board, talk to an insurance professional who actually understands the trades, and never assume that the legal minimum is enough to truly protect the business you've worked so hard to build.

Managing Your Certificates of Insurance

Once you’ve locked in the right coverage, the job isn’t quite finished. You need a simple, official way to prove it, and that’s where the Certificate of Insurance (COI) comes in. This single document is the key to building trust with clients and general contractors, serving as concrete proof that you meet all electrical contractor insurance requirements.

Think of a COI as a one-page snapshot of your insurance policies. It lists what coverages you have, your policy numbers, the effective dates, and your limits. It’s the standard way you show a project manager you’re properly insured before you ever set foot on their property.

Decoding the Language on a COI

When you look at a COI, a few specific terms might jump out. They sound complicated, but they’re actually straightforward concepts that are critical for protecting everyone involved. Let me break down the two most important ones.

- Additional Insured: This is an endorsement that extends your liability coverage to another party, usually the client or general contractor. If they get sued because of an accident your work caused, your policy steps in to help protect them, too. It’s a very common request, especially on commercial jobs.

- Waiver of Subrogation: This is an agreement where your insurance company gives up its right to sue the general contractor or client to get back money it paid out for a claim. For example, if your insurer pays a workers' comp claim for your injured employee, this waiver prevents them from turning around and suing the GC for that same amount.

Understanding these terms helps you confidently meet contractual demands without any confusion. If you ever have questions about these clauses, it's always a good idea to contact a trusted local electrician for advice on what is standard in your area.

How to Request and Review a COI

Getting a COI for a client is simple: just call or email your insurance broker and tell them who needs it. They can typically generate and send over a PDF within a few hours.

But what about when you’re the one hiring a subcontractor? You need to know how to spot red flags on the COI they provide you.

Expert Tip: Never accept an expired or altered COI. Always check the policy dates to ensure coverage is active for the entire duration of your project. A fraudulent certificate is a massive red flag that could leave you completely exposed if something goes wrong.

Here’s a quick checklist for reviewing a COI from a sub:

| What to Check | Why It's Important |

|---|---|

| Policy Effective Dates | Ensures the coverage is current and won't lapse mid-project. |

| Coverage Limits | Confirms they meet the minimums required in your contract. |

| Named Insured | Verifies the name matches the subcontractor’s company exactly. |

| Certificate Holder | Your business should be correctly listed as the holder. |

Properly managing your COIs—both the ones you issue and the ones you collect—is a vital part of your risk management strategy. It ensures that every single person on your job site is protected, building a foundation of trust and security from day one.

Your Action Plan for Getting the Right Coverage

Feeling a bit buried in policy types and legal jargon? Don't be. Getting the right insurance is a straightforward process when you break it down into a few common-sense steps. Let's map out a simple plan to make sure your business is buttoned up, legal, and ready for whatever the job site throws at you.

This isn't just about ticking a box. It's about building a smart risk management strategy so you can focus on your work with confidence. Honestly, a little prep work now can save you from a world of hurt later.

Step 1: Assess Your Unique Risks

First things first: you need a clear picture of what you're actually protecting. Not all electrical work carries the same risk, and your insurance should match the jobs you do. Think of it like choosing the right tool—you wouldn’t use a delicate multimeter where you need heavy-duty conduit benders.

Ask yourself these gut-check questions:

- What kind of work do I really do? The risks on a residential service call are worlds apart from a new commercial build. High-voltage industrial work? That’s another level of liability altogether.

- What’s the average value of my projects? A contractor wiring a multi-million dollar facility needs way higher liability limits than someone focusing on smaller home remodels.

- Do I have employees? If you have a crew, workers' comp isn't just a good idea—it's almost certainly the law.

- What are my biggest assets? Think about the value of your work van, specialty tools, and all the diagnostic gear that would bring your business to a halt if it were stolen or destroyed.

Answering these questions gives you a solid snapshot of your exposure. That’s exactly what a good insurance broker needs to build the right plan for you.

Step 2: Find a Broker Who Specializes in the Trades

Here’s the thing: you don't want a generalist who spends most of their day on home and auto policies. You need a broker who lives and breathes the construction industry and gets the specific headaches electricians face. A specialist knows the right questions to ask and has access to insurance carriers that build policies for contractors like you.

A knowledgeable broker is your advocate. They can translate the confusing clauses, shop around for the best rates, and make sure you’re not overpaying for coverage you don’t need—or worse, missing a critical endorsement that could save your business.

When you're vetting brokers, ask them point-blank about their experience with electrical contractors. A good one will immediately understand what you mean by tool floaters, professional liability for design-build work, and the certificate requirements GCs throw at you.

Step 3: Gather Your Info for an Accurate Quote

To get a real, no-surprises quote, you'll need to have some basic business details ready. Pulling this together beforehand makes the whole process faster and smoother.

Here's what you'll typically need to have on hand:

| Information Needed | Why It Matters |

|---|---|

| Business Name and Address | To identify your company and where you operate. |

| Years in Business | Experience often impacts rates; established businesses are often seen as lower risk. |

| Annual Revenue / Payroll | These numbers are the foundation for calculating liability and workers' comp premiums. |

| Description of Operations | A clear summary of the work you do (e.g., residential, commercial, industrial). |

| History of Past Claims | Your claims history helps insurers understand your risk profile. |

Step 4: Review and Renew Annually

Finally, remember this: your insurance needs aren't set in stone. As your business grows—you hire more people, take on bigger jobs, or buy that expensive new thermal camera—your coverage has to keep up.

Set a calendar reminder to connect with your broker at least once a year. That annual check-in ensures your protection still matches your operation, so you're never caught underinsured when it matters most.

Frequently Asked Questions

When you're busy running an electrical business, navigating the world of insurance can feel like a distraction. But getting clear on electrical contractor insurance requirements is one of the smartest things you can do to protect your hard work. Let's tackle some of the questions we hear all the time, no fluff.

Honestly, a few minutes spent understanding these points can save you a world of trouble later on.

What Is the Most Important Insurance for an Electrician?

If you only get one policy, make it General Liability insurance. This is the absolute foundation of your coverage. Why? It protects you from the things that can sink a business overnight: claims that your work caused property damage or bodily injury to a third party.

One slip-up on a job site—a damaged appliance or an accidental injury—can spiral into a claim worth hundreds of thousands of dollars. General Liability is non-negotiable for any serious electrician.

How Much Does Electrician Insurance Typically Cost?

You know what? There's no flat rate. The price tag on your insurance depends entirely on your specific business. Think of it like this:

- The kind of work you do: Wiring a new custom home is a different risk profile than servicing a massive industrial plant.

- The size of your operation: Your annual revenue and the number of folks on your team are big factors.

- Where you're located: Different states and even cities have unique regulations and risk levels that affect rates.

- Your track record: A clean claims history will almost always earn you better premiums.

For a small one-person shop, a basic General Liability policy might run anywhere from $50 to $150 a month, but that figure can shift dramatically based on the factors above.

Do I Need Workers Compensation if I Am a Sole Proprietor?

Here’s the thing: it all comes down to your state's laws. In many places, if you're a true sole proprietor with zero employees, you might not be legally required to carry a workers' comp policy on yourself. But that’s not the whole story. Many general contractors won't let you set foot on their job site without it, as it's a key part of their own risk management.

Key Insight: Even if the law doesn't force your hand, picking up a minimum premium or "ghost policy" for workers' comp can unlock bigger job opportunities. It also gives you a critical safety net if you ever decide to bring on a helper, even for a single day.

For a deeper dive into common concerns, you can explore our more extensive electrical contractor FAQ section for additional insights.